UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a -101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Ryerson Holding Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials:

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ryerson 2020 2024 Proxy Statement Notice of Annual Meeting of Stockholders

227 W. Monroe St., 27th Floor

Chicago, Illinois 60606

Notice of Annual Stockholders’ Meeting

Wednesday,Thursday, April 28, 2021 25, 2024,2:00 p.m.Central Daylight Time

Virtual Meeting via a live audio-only webcast at www.proxydocs.com/RYI

March 12, 20212024

To our Stockholders:

You are cordially invited to the 20212024 annual meeting of stockholders of Ryerson Holding Corporation scheduled to be held on Wednesday,Thursday, April 28, 2021,25, 2024, at 2:00 p.m. Central Daylight Time via a live audio-only webcast at www.proxydocs.com/RYI. There is no physical location for the 20212024 annual meeting. At the meeting, we will consider:

|

|

|

|

|

|

|

|

|

|

Stockholders who owned shares of our stock at the close of business on March 1, 20212024 can vote on these proposals.

Our 20212024 annual meeting of stockholders will be a virtual meeting. In order to attend the annual meeting, you must register in advance at www.proxydocs.com/RYI. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions.

Your vote is important regardless of the number of shares of stock you own. Whether you plan to attend or not, please review our proxy materials and request a proxy card to sign, date and return, or submit your voting instructions by telephone or through the Internet. On or about the date of this letter, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”). Instructions for each type of voting are included in the Notice that you received and in this proxy statement. If you plan to attend the meeting and prefer to vote at that time, you may do so. If you hold your shares through a broker, bank, or other institution, please be sure to follow the voting instructions that you receive from the holder. The holder will not be able to vote your shares on any of the proposals except the ratification of the appointment of Ernst & Young LLP unless you have provided voting instructions.

Mark S. Silver

Executive Vice President, General Counsel & Chief Human Resources Officer

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL ANNUAL REPORT ARE AVAILABLE AT http://www.proxydocs.com/RYI. |

RYERSON HOLDING CORPORATION

Table of Contents

1 |

| 30 | ||

2 |

|

|

| |

2 |

| 31 | ||

2 |

| 32 | ||

2 |

| 34 | ||

3 |

| 34 | ||

3 |

| 36 | ||

3 |

| 36 | ||

3 |

| 36 | ||

4 |

| 36 | ||

4 |

| Consideration of Results of Advisory Vote on | 37 | |

4 |

| |||

4 |

| 37 | ||

4 |

| 38 | ||

How Are Abstentions, Withheld Votes and Broker | 5 |

| 38 | |

|

| 39 | ||

5 |

| |||

5 |

| 39 | ||

How Do You Determine Whether I Get One or More | 5 |

| 40 | |

| 40 | |||

7 |

| 41 | ||

7 |

| 42 | ||

2. Ratification of the Appointment of Independent | 8 |

| 42 | |

| 43 | |||

3. Non-Binding, Advisory Vote on the Compensation | 9 |

| 44 | |

4. Non-Binding, Advisory Vote on the Frequency of the | 10 |

| 44 | |

| 44 | |||

5. Such Other Business as May Properly Come Before | 10 |

| 45 | |

| 45 | |||

11 |

| 46 | ||

11 |

| 46 | ||

11 |

| 47 | ||

12 |

| 48 | ||

13 |

| 48 | ||

14 |

| 49 | ||

18 |

| 49 | ||

19 |

| 49 | ||

19 |

| 49 | ||

19 |

| 50 | ||

21 |

| 50 | ||

21 |

| 50 | ||

22 |

| 50 | ||

22 |

| 50 | ||

22 |

| 51 | ||

23 |

| 51 | ||

23 |

| 52 | ||

23 |

| Narrative Relating to Summary Compensation Table | 53 | |

24 |

| |||

24 |

| 53 | ||

24 |

| 56 | ||

24 |

| 58 | ||

| 58 | |||

25 |

| 59 | ||

25 |

| 59 | ||

27 |

| 61 | ||

27 |

| 61 | ||

27 |

| 64 | ||

AUDIT COMMITTEE REPORT – FINANCIAL STATEMENTS RECOMMENDATION | 28 |

| 64 | |

| 66 | |||

29 |

| 66 | ||

30 |

| 67 |

RYERSON 2024 Proxy Statement | ii |

|

| |

| |

| |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

| |

|

|

| |

|

|

| ||

|

| |

Joseph T. Ryerson & Son was founded in 1842 as a little iron shop in the city of Chicago. Today, over 180 years strong, Ryerson is a leading supplier and processor of industrial metals. With over 100 locations, Ryerson has the largest interconnected metal network in North America. This extensive network includes suppliers, warehouses, depots, and processing centers. Ryerson is dedicated to providing great customer experiences. Ryerson Holding Corporation (“Ryerson,” the “Company,” “we,” “us” or “our”) is furnishing this proxy statement to the holders of our common stock in connection with the solicitation of proxies on behalf of our board of directors (the “Board”) for use at our 20212024 annual meeting of stockholders, which will be held on Wednesday,Thursday, April 28, 2021,25, 2024, via a live audio-only webcast at www.proxydocs.com/RYI. There is no physical location for the 20212024 annual meeting. We will begin sending notice of the availability of these proxy materials on or about March 12, 2021.

2024. Our common stock trades on the New York Stock Exchange (“NYSE”) under the ticker symbol ‘RYI’. The Company’s fiscal year ends on December 31 of each calendar year. Our corporate headquarters is located at 227 W. Monroe St., 27th Floor, Chicago, Illinois 60606, and our website address is www.ryerson.com.www.ryerson.com. Please note that the information on our website is not, and shall not be deemed to be, a part of this proxy statement nor, by reference or otherwise (except to the extent we specifically incorporate it by reference), incorporated into any other filings we make with the Securities and Exchange Commission (“SEC”).

On August 13, 2014, we completed an initial public offering of 11 million shares of our common stock (the “IPO”). Prior to that time, all of our common stock was held by affiliates of Platinum Equity, LLC (together with such affiliates, “Platinum”), which still own approximately 55%approximately11.5% of Ryerson’s common stock. For additional information regarding Platinum’s ownership, see below under “Ownership of More Than 5% of Ryerson Stock,Stock.” on page 50.

As the context requires, “Ryerson,” the “Company,” “we,” “us” or “our” may also include the direct and indirect subsidiaries of Ryerson Holding Corporation.

RYERSON 2024 Proxy Statement |1

Annual Meeting Information

Annual Meeting Information

|

This proxy statement contains information we must provide to you under the rules of the SEC and the NYSE in connection with the solicitation of proxies by our Board for the 20212024 annual meeting of stockholders. It is designed to assist you in voting your shares of our stock.

You may vote if you were the holder of record of shares of our common stock at the close of business on March 1, 2021.2024. You are entitled to one vote on each matter presented at the 20212024 annual meeting of stockholders for each share of our stock you owned at that time. If you held stock at that time in “street name” through a broker, bank or other institution, you must either provide voting instructions to the holder or obtain a proxy, executed in your favor, from the holder to be able to vote those shares at the meeting.

Each share of Ryerson common stock is entitled to one vote. As of the close of business on March 1, 20212024 (the record date for determining stockholders entitled to vote at the annual meeting), we had 38,117,39734,018,705 shares of common stock outstanding and entitled to vote.

You are entitled to attend our 20212024 annual meeting if you were the holder of record of shares of our common stock at the close of business on March 1, 20212024 or if you hold a valid proxy for the annual meeting.

This year’s annual meeting will be accessible through the Internet via a live audio-only webcast. You are invited to attend the annual meeting via audio-only webcast to vote on the proposals described in this Proxy Statementproxy statement so long as you register to attend the annual meeting at www.proxydocs.com/RYI. You will be asked to provide the control number located inside the shaded gray box on your notice or proxy card (the “Control Number”) as described in the Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) or proxy card. After completion of your registration, further instructions, including a unique link to access the annual meeting of stockholders, will be emailed to you. If you request a printed copy of our proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use. This year’s stockholder question and answer session will include questions submitted in advance of the annual meeting. You may submit a question in advance of the meeting at www.proxydocs.com/RYI after logging in with your Control Number.

You are voting on:

|

|

|

|

|

|

|

|

• Such other business as may properly come before the meeting. RYERSON 2024 Proxy Statement |2 Annual Meeting Information |

|

|

If your shares of stock are registered directly in your name, you are considered a stockholder of record and you will receive your Notice directly from us. Stockholders of record can vote in advance of our annual meeting by requesting a proxy card to sign, date and return or by submitting voting instructions by telephone or through the Internet. Please see the Notice you received or this proxy statement for specific instructions on how to cast your vote by any of these methods.

To vote during the annual meeting, you must do so through www.proxydocs.com/RYI. To be admitted to the annual meeting and vote your shares, you must register and provide the Control Number as described in the Internet Availability Notice or Proxy Card. After completion of your registration, further instructions, including a link a unique link to access the annual meeting, will be emailed to you.

If you hold your shares of stock through a broker, bank or other institution, you fareare considered the beneficial owner of stock held in “street name” and you will receive your notice from your broker, bank or other institution.

|

For stockholders of record, voting instructions submitted via mail, telephone or the Internet must be received by our independent tabulator, Mediant, by the closing of the polls at the annual meeting. Submitting your voting instructions prior to the annual meeting will not affect your right to vote in person should you decide to attend the meeting.

Stockholders of Record Can Vote By:

|

|

|

|

|

|

Instructions and contact information for each of these voting options can be found in our Notice of Internet Availability of Proxy Materials.

The Internetinternet and telephone voting procedures available to you are designed to authenticate stockholders’ identities, to allow stockholders to submit voting instructions and to confirm that stockholders’ voting instructions have been recorded properly. We have been advised that the Internetinternet and telephone voting procedures are consistent with the requirements of applicable law. Stockholders voting via the Internetinternet or telephone should understand that there may be costs associated with voting in this manner, such as usage charges from Internetinternet access providers and telephone companies, which must be borne by the stockholder.

If you hold your stock in street name, you can vote by submitting a voting instruction card to your broker, bank or other institution that sent your Notice to you in accordance with their procedures. Please note that if you hold your stock in street name, the broker, bank or other institution that holds the stock will not be able to vote your shares on any proposal other than the ratification of the appointment of Ernst & Young LLP unless you have provided voting instructions. If you hold your stock in street name and wish to vote at the meeting, you must obtain a proxy, executed in your favor, from the holder of record of the stock as of the record date.

Annual Meeting Information

What If I Do Not Provide Voting Instructions?

If you submit a valid proxy card, or validly submit voting instructions via the telephone or Internet,internet, but you do not indicate your vote, your shares of stock will be voted FOR:

|

|

|

|

|

|

|

|

You also give the proxies discretionary authority to vote on any other business that may properly be presented at the annual meeting.

Can I Revoke or Change My Vote?

If you are a stockholder of record, you may revoke or change your proxy and voting instructions at any time prior to the vote at the annual meeting. To do so:

|

|

|

|

If you hold your stock in street name, you may revoke or change your proxy instructions prior to the vote at the annual meeting by submitting new voting instructions to your broker, bank or other institution in accordance with their procedures.

|

Who Are the Proxies andand What Do They Do?

When you vote in advance of the annual meeting, you appoint Mr. Mark S. Silver, our Executive Vice President, General Counsel & Chief Human Resources Officer, and Ms. Camilla R. Merrick, our Corporate Secretary, as proxies, each with the power to appoint a substitute. You direct them to vote all of the shares of stock you held on the record date at the annual meeting and at any adjournment or postponement of that meeting. If you submit a valid proxy card or validly submit voting instructions via the telephone or Internet,internet, and you do not subsequently revoke your proxy or vote, the individuals named on the card as your proxies will vote your shares of stock in accordance with your instructions. If you submit a valid proxy card or voting instructions but you do not indicate your vote, your shares of stock will be voted as described above under “What If I Do Not Provide Voting Instructions?” on page 3.this page.

We have a confidential voting policy. Stockholders’ votes will not be disclosed to us other than in limited situations. The independent tabulator will collect, tabulate and retain all proxies and will forward any comments written on the proxy cards or otherwise received by the independent tabulator to management. Our confidential voting policy will not apply in the event of a contested solicitation.

What Is the Quorum Requirement for the Annual Meeting?

A quorum is necessary to hold a valid meeting. A quorum will exist if stockholders holding a majority of the shares of stock issued and outstanding and entitled to vote at the meeting are present in person or represented by proxy.

Annual Meeting Information

How Are Abstentions, Withheld Votes and Broker Non-Votes Treated?

The election inspector will treat abstentions, withholds and “broker non-votes” as shares of stock that are present and entitled to vote for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker holding stock for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Brokers will have discretionary voting power with respect to proposal two (the ratification of the appointment of Ernst & Young LLP), but not with respect to any other proposal. AbstentionsWith respect to Proposal One, abstentions do not count as votes cast either for or against the proposal. With respect to Proposals Two, Three and brokerFour, abstentions will have the same effect as a vote cast against the proposals. Broker non-votes doand withheld votes will not count as votes cast either for or against any of the proposals. A “withhold” vote with respect to any director nominee will have the effect of a vote against such nominee.

What Vote Is Required to Approve a Proposal?

Proposal One: AThe director nominee will benominees who receive the most “for” votes are elected to the Board ifboard until all board seats are filled. In an uncontested election, where the number of votes castnominees and available board seats are equal, every nominee is elected upon receiving just one “for” the nominee’s election exceeds the number of votes “withheld” from the nominee’s election.vote.

Proposal Two: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 20212024 will be approved if holders of a majority of the stock present in person at the meeting or represented by proxy vote in favor of the proposal.

Proposal Three:The adoption, on a non-binding, advisory basis, of a resolution approving the compensation of our named executive officers described under the heading “Executive Compensation”Executive Compensation in our proxy statement (“say-on-pay” vote) will be approved on a non-binding, advisory basis, if holders of a majority of the stock present in person at the meeting or represented by proxy vote in favor of the proposal.

Proposal Four: A pluralityFour:The adoption of the affirmative votes cast will select, onadvisory resolution that a non-binding, advisory basis the frequency of the stockholder vote onto approve the compensation of our named executive officers. Weofficers be held EVERY YEAR (“say-when-on-pay” vote) will be approved if holders of a majority of the stock present in person at the meeting or represented by proxy vote in favor of the proposal. However, because this proposal has three choices, it is possible that no choice will receive an affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote thereon at the 2024 annual meeting. Therefore, the Board will consider stockholders to have expressed a non-binding preference for the frequencychoice that receives the highest number of favorable votes.votes as the choice supported by our stockholders.

Who Solicits Proxies and How Are They Paid?

The proxy accompanying this proxy statement is solicited on behalf of our Board for use at the annual meeting and Ryerson pays the expenses of soliciting the proxies. In addition to this solicitation by mail, our directors, officers and other employees may contact you by personal interview, telephone, electronic mail, facsimile, Internetinternet or otherwise to obtain your proxy. These persons will not receive any additional compensation for these activities. Brokerage houses and other custodians, nominees and fiduciaries will be requested to forward solicitation material to the beneficial owners of stock. We will reimburse these entities and our transfer agent for their reasonable out-of-pocket expenses in forwarding solicitation material. We have not retained the services of a proxy solicitor.

How Do You Determine Whether I Get One or More Paper Copies of the Proxy Materials?

To reduce the costs of printing and distributing proxy materials we are taking advantage of the SEC rule that allows companies to furnish their proxy materials over the Internet.internet. As a result, we send many stockholders a notice regarding the Internetinternet availability of the proxy materials instead of a paper copy of our proxy materials. This notice explains how you can access the proxy materials over the Internet,internet, and also describes how to request to receive a paper copy of the proxy materials. If you have requested paper copies of the proxy materials, you may have received one copy of our proxy statement, annual report or Notice for multiple stockholders in your household. This is because we and some brokers,

RYERSON 2024 Proxy Statement |5

Annual Meeting Information |

banks and other record holders participate in the practice of “householding” proxy statements, annual reports and Notices of Internet Availability of Proxy Materials and deliver only one copy to stockholders at one address unless we or they receive other instructions from you.

If these materials were delivered to an address that you share with another stockholder, we will promptly deliver a separate copy if you make a written or verbal request to Ryerson Holding Corporation, Investor Relations, 227 W. Monroe St., 27th Floor, Chicago, Illinois 60606, email: investorinfo@ryerson.com, or telephone: 312-292-5130.

If you are receiving multiple copies and would like to receive only one copy for your household, you may make such request as follows:

|

|

|

|

The Company’s proxy materials are also available at ir.ryerson.com.

RYERSON 2024 Proxy Statement |6

Items You May Vote on

Items You May Vote on

|

Our Board presently consists of seveneight directors, threeseven of whom our Board has determined to be independent under the NYSE Listed Company Manual and other NYSE rules and requirements (together, “NYSE rules”). Four of our directors are affiliated with Platinum, which owns a majority of our outstanding common stock. Because Platinum owns more than 50% of the voting power of our common stock, we are considered to be a “controlled company” for purposes of the NYSE rules. As such, we are permitted, and have elected, to opt out of the NYSE rules that would otherwise require our Board to be comprised of a majority of independent directors.

The Board is divided into three separate classes, with one class being elected each year to serve a staggered three-year term. The terms of the Class I Directors expire at the 20212024 annual meeting, and three directors will be elected at the annual meeting to serve as Class I Directors for a three-year term expiring at the 20242027 annual meeting or until their successors are duly elected and qualified. We believe that our staggered board structure provides several advantages including promoting director participation and independence, as well as promoting board stability, continuity and institutional knowledge. We also believe this structure provides our Board with the ability to focus on the long-term strategies and objectives of the Company.

For the 20212024 annual meeting, the Board has proposed the following director nominees for election: Eva M. Kalawski, Mary Ann Sigler, and Court D. Carruthers.Carruthers, Karen M. Leggio and Michelle A. Kumbier. Two of our current directors, Mses. Kalawski and Sigler, have not been nominated for re-election to the Board, and will cease to serve as directors immediately following the conclusion of the meeting.

Detailed information on each director nominee and continuing director is provided below under “Biographies” on page 11.14. If you submit valid voting instructions, the proxies will vote your shares of stock for the election of each of the nominees, unless you indicate that you wish to withhold your vote on a nominee. If at the time of the annual meeting any of the nominees is unable or declines to serve, the persons named in the proxy will, at the direction of the Board, either vote for the substitute nominee or nominees that the Board recommends, or the Board may reduce the number of directors to be elected at the meeting. The Board has no reason to believe that any nominee will be unable or will decline to serve as a director if elected.

Vote Required

Under our Bylaws, our directors are elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote in the election of directors. With plurality voting, the nominees who receive the most “for” votes are elected to the board until all board seats are filled. In an uncontested election, a directorwhere the number of nominees and available board seats are equal, every nominee is elected if the votes castupon receiving just one “for” the director’s election exceed the votes “withheld” from the director’s election.vote.

Recommendation of the Board

OUR BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” the election of Eva m. kalawski, mary ann sigler,COURT D. CARRUTHERS, KAREN M. LEGGIO and court d. carruthersMICHELLE A. KUMBIER to serve as directors of the Company.

RYERSON 2024 Proxy Statement |7

|

Items You May Vote on

Our Audit Committee has selected Ernst & Young LLP to serve as our independent registered public accounting firm for 2021.2024. Ernst & Young has served as the independent registered public accounting firm for the Company since 2006. Representatives of Ernst & Young will be present at the annual meeting to answer questions. They will also have the opportunity to make a statement if they desire to do so.

The Audit Committee is responsible for recommending, for stockholder approval, our independent registered public accounting firm. Should stockholders fail to approve the ratification of the appointment of Ernst & Young, the Audit Committee would undertake the task of reviewing the appointment. Nevertheless, given the difficulty and expense of changing independent accountants mid-way through the year, there is no assurance that a firm other than Ernst & Young could be secured to deliver any or all of the Company’s independent auditing services required in 2021.2024. The Audit Committee, however, would take the lack of stockholder approval into account when recommending an independent registered public accounting firm for 2021.2025.

The following table sets outforward the various fees for services provided by Ernst & Young for 20202023 and 2019.2022. The Audit Committee pre-approved all of these services. For additional information, see the description of the pre-approval policies and procedures of the Audit Committee under “Pre-approval Policies,” below on page 19.27.

Annual Fees for 20202023 and 20192022

|

| Amounts | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description |

| 2023 |

| 2022 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit Fees(1) |

| $3,799,694 |

|

| $4,205,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Fees(2) |

| 47,800 |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Fees(3) |

| $11,994 |

|

| $3,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| $3,859,488 |

|

| $4,209,360 |

|

|

|

|

|

|

|

|

|

| Amounts |

| |||||

| 2020 |

|

| 2019 |

| |||

Audit Fees(1) |

| $ | 3,896,583 |

|

| $ | 4,282,240 |

|

Audit-related Fees(2) |

|

| — |

|

|

| — |

|

Tax Fees(3) |

| $ | 133,582 |

|

| $ | 454,925 |

|

Other Fees(4) |

|

| — |

|

|

| — |

|

Total |

| $ | 4,030,165 |

|

| $ | 4,737,165 |

|

|

|

|

|

|

|

|

|

Ernst & Young LLP’sYoung’s full-time, permanent employees conducted a majority of the audit of the Company’s 20202023 financial statements. Leased personnel were not employed with respect to the domestic audit engagement.

Vote Required

The approval of this proposal requires the affirmative vote of a majority of the votes castshares present in person or by proxy and entitled to vote thereon at the 20212024 annual meeting, assuming that a quorum is present.

Recommendation of the Board

OUR BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” the ratification of the appointment of Ernst & Young as our independent registered public accounting firm for 2021.2024.

Items You May Vote on

Section 14A of the Securities Exchange Act of 1934 (“Section 14A”) requires that the Company provide its stockholders with the opportunity to vote to approve, on a non-binding advisory basis, the compensation of its named executive officers at least once every three years. At the 2018 annual meeting, the stockholders followed the recommendation of our Board of Directors to hold an advisory vote on executive compensation once every three years. In 2018,2021, the stockholders voted, and the Board of Directors determined, that the stockholders should vote on a say-on-pay proposal once every three years to provide the Company with sufficient time to thoughtfully consider the results of the vote and implement any desired changes to executive compensation policies and procedures. The last vote was held in 2018. Accordingly, the Company is seeking your vote to approve, on a non-binding advisory basis, the compensation of our named executive

|

officers as disclosed in this proxy statement (the “Say-on-Pay Vote”). This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Stockholders are urged to read the “Executive Compensation” section of this proxy statement, beginning on page 26, which discusses how our executive compensation policies and procedures implement our compensation philosophy and contains tabular information and narrative discussion about the compensation of our named executive officers. The Compensation Committee and the Board believe that these policies and procedures are effective in implementing our compensation philosophy and in achieving our goals.

As an advisory vote, the vote on this proposal is not binding. However, our Board and Compensation Committee, which is responsible for designing and administering our executive compensation program, value the opinions expressed by stockholders in their vote on this proposal, and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

Based on the above, we request that you indicate your support for our executive compensation practices by voting in favor of the following resolution:

“RESOLVED, that the Company’s stockholders approve the compensation of the Company’s named executive officers as described in this Proxy Statement in the “Executive Compensation” section, including the Compensation Discussion and Analysis and the related compensation tables and narrative.”

Vote Required

The approval of this proposal requires the affirmative vote of a majority of the votes castshares present in person or by proxy and entitled to vote thereon at the 20212024 annual meeting, assuming that a quorum is present.

Recommendation of the Board

Our Board of Directors unanimously recommends a voteOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” the adoption,THE ADOPTION, ON A NON-BINDING, ADVISORY BASIS, OF THE RESOLUTION APPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS DESCRIBED UNDER THE HEADING “EXECUTIVE COMPENSATION” IN OUR PROXY STATEMENT.

RYERSON 2024 Proxy Statement |9

Items You May Vote on a non-binding, advisory basis, of the resolution approving the compensation of our named executive officers described under the heading “Executive Compensation” in our proxy statement.

Section 14A also provides that we include in this proxy statement a separate, advisory, non-binding stockholder vote on whether the Say-on-Pay Vote should occur every one, two or three years (Say-When-on-Pay Vote). Stockholders have the option to vote for any one of the three options, or to abstain on the matter.

The Board has determined that an advisory vote on executive compensation every three yearsyear is the best approach for the Company based on a number of considerations, including the following:

●

● A three-year

The stockholders also have the opportunity to provide additional feedback on important matters, involvingincluding executive compensation even in years when a Say-on-Pay Vote does not occur.throughout the year. As discussed under “Communications with the

|

Board” on page 17,23, the Company provides stockholders an opportunity to communicate directly with the Board on any issue, including executive compensation.

You may indicate your preferred voting frequency by voting for the option of three years, two years, or one year, or you may abstain from voting. We will consider stockholders to have expressed a non-binding preference for the frequency that receives the highest number of favorable votes.

Although this selection is non-binding in nature, our Board and Compensation Committee, which is responsible for designing and administering our executive compensation program, value the opinions expressed by stockholders in their vote on this proposal, and will consider the stockholders’ preference in determining the frequency of future votes on compensation program for our named executive officers. However, the Board may decide that it is in the best interests of our stockholders and the Company to hold a non-binding, advisory Say on Pay Vote more or less frequently than the option selected by our stockholders.

The Board of Directors unanimously recommends that a non-binding, advisory vote to approve the compensation of our named executive officers be held every THREE years.EVERY YEAR.

Vote Required

The approval of this proposal requires the affirmative vote of a majority of the votes castshares present in person or by proxy and entitled to vote thereon at the 20212024 annual meeting, assuming that a quorum is present. Because this proposal has three choices, it is possible that no choice will receive an affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote thereon at the 2024 annual meeting, in which case the Board will consider the choice that receives the highest number of votes as the choice supported by our stockholders.

Recommendation of the Board

Our Board of Directors unanimously recommends a voteOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” the adoption, on a non-binding, advisory basis, of the resolution approving the Non-Binding, Advisory Vote on the Frequency of the Stockholder Vote on Executive Compensation of our named executive officers described under the heading “Executive Compensation” in our proxy statement.THE ADOPTION, ON A NON-BINDING, ADVISORY BASIS, OF THE RESOLUTION APPROVING THE NON-BINDING, ADVISORY VOTE ON THE FREQUENCY OF EVERY YEAR OF THE STOCKHOLDER VOTE ON EXECUTIVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS DESCRIBED UNDER THE HEADING “EXECUTIVE COMPENSATION” IN OUR PROXY STATEMENT.

We do not know of any other matters to be voted on at the meeting. If, however, other matters are properly presented for a vote at the meeting, the persons named as proxies will vote your properly submitted proxy according to their judgment on those matters.

RYERSON 2024 Proxy Statement |10

Board of Directors

Board of Directors

|

Composition of the Board of Directors

Our Amended and Restated Certificate of Incorporation and Bylaws provide that the authorized number of directors shall be fixed from time to time by a resolution of the majority of our Board. Our Board is currently comprised of the following seveneight members: Kirk K. Calhoun, Court D. Carruthers,

Kirk K. Calhoun | Court D. Carruthers | Eva M. Kalawski | Jacob Kotzubei | |||

Stephen P. Larson | Edward J. Lehner | Philip E. Norment | Mary Ann Sigler |

Two of the current directors, Mses. Kalawski Jacob Kotzubei, Stephen P. Larson, Philip E. Norment and Mary Ann Sigler.Sigler, have not been nominated for re-election to the Board, and will cease to serve as directors immediately following the conclusion of the meeting. Accordingly, their biographies are not presented below.

In connection with the IPO, the Company and Platinum entered into an amended and restated investor rights agreement (the “Investor Rights Agreement”) in August 2014 that provided, among other things, that for so long as Platinum collectively beneficially owns (i) at least 30% of the voting power of the outstanding capital stock of the Company, Platinum will have the right to nominate for election to the Board no fewer than that number of directors that would constitute a majority of the number of directors if there were no vacancies on the Board, (ii) at least 15% but less than 30% of the voting power of the outstanding capital stock of the Company, Platinum will have the right to nominate two directors and (iii) at least 5% but less than 15% of the voting power of the outstanding capital stock of the Company, Platinum will have the right to nominate one director. The agreement also provides that if the size of the Board is increased or decreased at any time, Platinum’s nomination rights will be proportionately increased or decreased, respectively, rounded up to the nearest whole number. UnderAs of February 16, 2024, Platinum owned 11.5% of the voting power of the outstanding capital stock of the Company. Based on the size of the Board as of February 15, 2024, Platinum has the right to nominate up to two directors pursuant to the Investor Rights Agreement, Platinum has nominated Ms. Kalawski, Mr. Kotzubei, Mr. Norment and Ms. Sigler. Agreement.

Our Corporate Governance Guidelines provide that if an officer serving on our Board resigns or retires from his or her executive position with the Company or if a non-management director’s external job changes from the time such director was last elected, such individual shall offer his or her resignation from the Board at the same time; however, whether or not the individual shall continue to serve on the Board is a matter for determination on a case-by-case basis by the Board.

TermTerms and Classes of Directors

Our Board is divided into three staggered classes of directors of the same or nearly the same number. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The terms of the directors will expire upon election and qualification of successor directors at the annual meeting of stockholders to be held during the years 20212024 for the Class I directors, 20222025 for the Class II directors and 20232026 for the Class III directors.

|

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class shall consist of one-third of the directors. The following table sets forth information as of the date of this proxy statement regarding the nominees for directors and other directors who will serve as directors in the classes and for the terms specified below:

RYERSON 2024 Proxy Statement |11

Board of Directors

Name |

| Independent |

| Age |

| Director |

| Self-Identified |

| Self-Identified |

| Executive |

| Audit |

| Compensation |

| Nominating |

| Expiration of | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominees for Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Court D. Carruthers |

|

| yes |

|

|

| 51 |

|

|

| 2015 |

|

|

| M |

|

|

|

|

|

|

|

|

|

|

| X |

|

|

|

|

|

|

|

|

|

|

| 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michelle A. Kumbier(5) |

|

| yes |

|

|

| 57 |

|

|

|

|

|

|

| F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Karen M. Leggio |

|

| yes |

|

|

| 61 |

|

|

|

|

|

|

| F |

|

|

| X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen P. Larson |

|

| yes |

|

|

| 67 |

|

|

| 2014 |

|

|

| M |

|

|

|

|

|

|

| X |

|

|

| X |

|

|

|

|

|

|

| Chair |

|

|

| 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip E. Norment |

|

| yes |

|

|

| 64 |

|

|

| 2014 |

|

|

| M |

|

|

|

|

|

|

| X |

|

|

|

|

|

|

|

|

|

|

| X |

|

|

| 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class III |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirk K. Calhoun |

|

| yes |

|

|

| 79 |

|

|

| 2014 |

|

|

| M |

|

|

|

|

|

|

|

|

|

|

| Chair (F) |

|

|

| Chair |

|

|

|

|

|

|

| 2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jacob Kotzubei |

|

| yes |

|

|

| 55 |

|

|

| 2010 |

|

|

| M |

|

|

|

|

|

|

| Chair |

|

|

|

|

|

|

| X |

|

|

|

|

|

|

| 2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edward J. Lehner |

|

|

|

|

|

| 58 |

|

|

| 2022 |

|

|

| M |

|

|

|

|

|

|

| X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2026 |

|

1 URM: Underrepresented Minority.

* Current term expires at this annual meeting.

(F) Audit Committee Financial Expert

The standing committees of the Board, with the membership indicated as of February 17, 2024, are set forth in the table above. The Board has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Board also appoints an ad hoc Transaction Committee from time to time as needed.

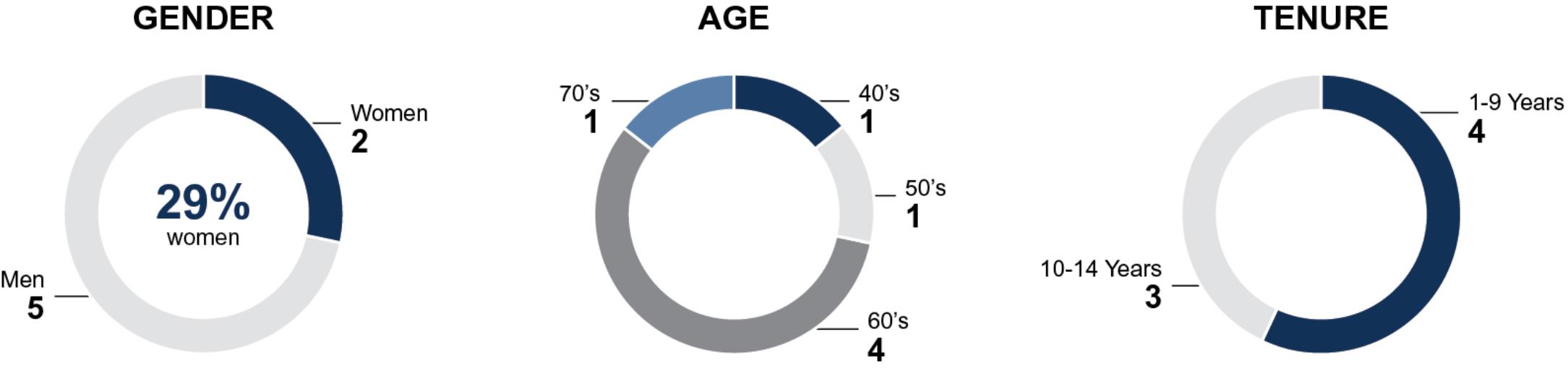

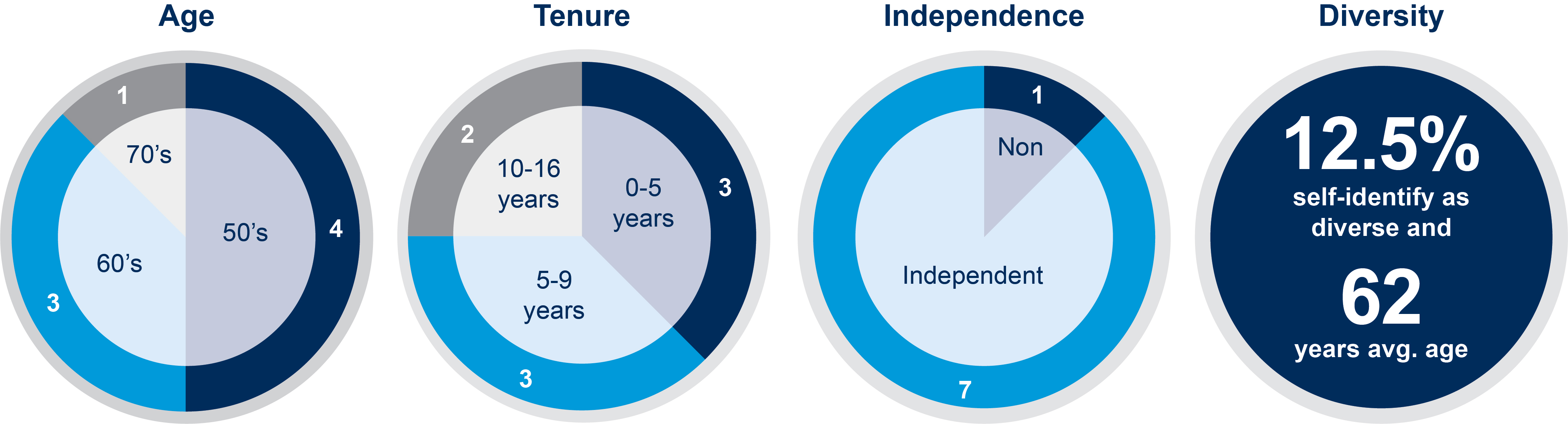

Board Diversity

Name |

| Age |

|

| Director Since |

| Expiration of Current Term | |

|

|

|

|

|

|

|

| |

Class I |

|

|

|

|

|

|

|

|

Court D. Carruthers |

|

| 48 |

|

| 2015 |

| 2021* |

Eva M. Kalawski |

|

| 65 |

|

| 2007 |

| 2021* |

Mary Ann Sigler |

|

| 66 |

|

| 2010 |

| 2021* |

Continuing Directors |

|

|

|

|

|

|

|

|

Class II |

|

|

|

|

|

|

|

|

Stephen P. Larson |

|

| 64 |

|

| 2014 |

| 2022 |

Philip E. Norment |

|

| 61 |

|

| 2014 |

| 2022 |

Class III |

|

|

|

|

|

|

|

|

Kirk K. Calhoun |

|

| 76 |

|

| 2014 |

| 2023 |

Jacob Kotzubei |

|

| 52 |

|

| 2010 |

| 2023 |

RYERSON 2024 Proxy Statement |12

Board of Directors

Director Skills & Experience

Among the qualifications, qualities and skills of a candidate considered important by the Nominating and Corporate Governance Committee are a commitment to representing the long-term interests of the shareholders, an inquisitive and objective perspective, the willingness to take appropriate risks, leadership ability, personal and professional ethics, integrity and values, practical wisdom and sound judgment, and business and professional experience in fields such as operations, supply chain and distribution. When evaluating re-nomination of existing directors, the Committee also considers the nominees’ past and ongoing effectiveness on the Board and, with the exception of Mr. Lehner, who is employed by the Company, their independence. The Committee believes that each of the director nominees for the 2024 Annual Meeting possesses these attributes.

|

| Kotzubei | Lehner | Carruthers | Kumbier | Leggio | Larson | Norment |

PUBLIC COMPANY Experience serving as a public company director; demonstrated understanding of current corporate governance standards and | • | • | • | • | • | • | • | |

CEO OR SENIOR MANAGEMENT “C-Suite” experience with a public company and/or leadership experience as a division president or functional leader within a complex organization. | • | • | • | • | • | • | • | |

INDUSTRY AND OPERATIONS Experience developing and implementing operating plans and business strategy. | • | • | • | • | • | • | • | |

FINANCE/ACCOUNTING Knowledge of finance or financial reporting; experience with debt and capital market transactions and/or M&A. | • | • | • | • | • | • | • | • |

RISK MANAGEMENT Experience overseeing complex enterprise risk management matters. | • | • | • | • | • | • | • | |

CYBERSECURITY/DATA PRIVACY Experience implementing IT strategies and managing cybersecurity risks. | • | • | • | |||||

CORPORATE GOVERNANCE & SUSTAINABILITY Informed on Company issues related to sustainability, including environmental, social and governance issues while monitoring emerging issues potentially affecting the | • | • | • | • | • | • | ||

SUPPLY CHAIN/LOGISTICS Experience in supply chain management encompassing the planning and management of all activities involved in sourcing and procurement, conversion, and all logistics management activities. | • | • | • | • | • | |||

HUMAN RESOURCES/ COMPENSATION Experience managing a human resources/compensation function; experience with executive compensation and broad-based incentive planning. | • | • | • | • | • | • | • | • |

RYERSON 2024 Proxy Statement |13

Board of Directors

Additional information regarding the nominees and continuing directors is set forth below and is based on information furnished to us by the nominees and directors:directors.

The Board has nominated Mses. KalawskiKumbier and Sigler,Leggio and Mr. Carruthers for election at the 20212024 annual meeting, each to hold office until the annual meeting of stockholders in 20242027 (subject to the election and qualification of their successors or the earlier of their death, resignation or removal). EachMr. Carruthers is currently a director.

Two of our current directors, Mses. Kalawski and Sigler, have not been nominated for re-election to the Board, and will cease to serve as directors immediately following the conclusion of the meeting.

|

|

Director since: | |

|

|

August 2015 |

|

| ||||

Court D. Carruthers serves as President and CEO of TricorBraun, Inc., a global packaging solutions company, where he is also a director. He is the founder and principal of CKAL Advisory Partners, LLC. He previously served as Senior Vice President and Group President, Americas, of W.W. Grainger, Inc., a broad-line supplier of maintenance, repair and operating (MRO) products, from 2013 until July 2015. Prior to that time, he had served as President, Grainger U.S., from 2012 until 2013; President, Grainger International, from 2009 until 2012; and President, Acklands-Grainger, from 2006 until 2009. He was appointed a Senior Vice President of Grainger in 2007. Mr. Carruthers | ||||

| ||||

Michelle A. Kumbier | Public Company Directorships: | |||

Abbott Laboratories (NYSE: ABT) Teledyne Technologies Incorporated (NYSE: TDY) | ||||

Michelle A. Kumbier currently serves as the Senior Vice President and President of the Turf and Consumer Products business of Briggs & Stratton LLC (NYSE: BGG) (“B&S”), a designer, manufacturer, seller and servicer of gasoline engines for outdoor power equipment. Prior to joining B&S in 2022, Ms. Kumbier served as the Chief Operating Officer of Harley-Davidson, Inc. (“HD”) from 2017 to 2020 after holding numerous leadership positions of increasing responsibility in the areas of supply chain, manufacturing, product development, aftermarket, and sales during her more than two decades at HD. Prior to her time at HD, Ms. Kumbier started her career at Kohler Company Inc., holding various positions over an eleven-year period in operations, sales and customer service in the plumbing products and engines divisions. Ms. Kumbier previously served on the board of directors of Tenneco Inc. Ms. Kumbier earned a Master of Business Administration from the University of Wisconsin, a Bachelor of Arts in Marketing from Lakeland College and an Associate Degree in Materials Management from Lakeshore Technical College. Ms. Kumbier’s extensive senior management experience has led the Board to conclude that she has the background and skills necessary to serve as a director of the Company. | ||||

RYERSON 2024 Proxy Statement |14

Board of Directors

Karen M. Leggio | ||||

Karen M. Leggio most recently served as the Senior Vice President and General Manager from 2019 to 2023 of the Channel and Distribution Business Unit of TE Connectivity Ltd (“TE”) (NYSE: TEL), a manufacturer and seller of connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas. In this role she also had responsibility for TE's global customer care organization. From 2010 to 2019 she held various leadership positions at TE, including Senior Vice President of Sales and Operations Planning, Senior Vice President and General Manager of TE’s Americas automotive business, Chief Supply Chain Officer, and Chief Procurement Officer. Prior to joining TE, Karen served as the Vice President of Global Supply Chain for Ingersoll Rand Inc. from 2007 to 2010. Prior to that, she spent twenty-three years (1985-2007) at General Motors Company holding multiple leadership roles of increasing responsibility in the areas of operations, procurement, logistics, supplier quality, and program management, including Vice President of Global Purchasing and Supply Chain for Latin America, Africa and the Middle East, Executive Director of Global Electrical Purchasing and Supply Chain, Director of Global Purchasing and Supply Chain for the United Kingdom, and Director of Program Purchasing. Ms. Leggio earned a Master’s of Science Degree in Operations from Purdue University and a Bachelor of Arts in Materials and Logistics Management (Supply Chain Management) from Michigan State University. Ms. Leggio’s extensive senior management experience has led the Board to conclude that she has the background and skills necessary to serve as a director of the Company. | ||||

RYERSON 2024 Proxy Statement |15

Board of Directors

Continuing Directors

Messrs. Calhoun, Kotzubei, Larson, Lehner and Norment will remain directors after the annual meeting.

| Kirk K. | Director since: | ||

August 2014 | ||||

Kirk K. Calhoun joined the public accounting firm Ernst & Young LLP in 1965 and served as a partner of the firm from 1975 until his retirement in 2002. Mr. Calhoun currently serves as a member of the board of three private companies, including NantHealth, Inc. Further, Mr. Calhoun previously served on the boards of several private and public companies in the life sciences industry up until the dates of their respective sales, including PLx Pharma, Inc. (NASDAQ: PLXP), Abraxis Bioscience, Inc., Myogen, Inc., Aspreva Pharmaceutical Corporation, Adams Respiratory Therapeutics, Inc., and Replidyne, Inc. Mr. Calhoun received a Bachelor of Science in Accounting from the University of Southern California. Mr. Calhoun’s experience serving on public company audit committees and boards of directors and his past work as a partner with Ernst & Young LLP has led the Board to conclude that Mr. Calhoun has the requisite expertise to serve as a director of the Company and qualifies as a financial expert for audit committee purposes. | ||||

Jacob | Director since: | Public Company Directorships: | ||

| January 2010 | Vertiv Holding Co (NYSE: VRT) | ||

Jacob Kotzubei joined Platinum in 2002 and is a | ||||

Edward J. | Director since: | |||

February 2022 | ||||

Edward J. Lehner has been our President & Chief Executive Officer since June 2015. Previously, he had served as our Executive Vice President and Chief Financial Officer since August 2012. Prior to joining the Company, he served as chief financial officer and chief administrative officer for PSC Metals, Inc. from 2009 to 2012. PSC Metals is a North American ferrous and non-ferrous scrap processor. Mr. Lehner is a current member, and from July 1, 2019, through June 2021 Mr. Lehner served as Chairman, of the Board of Directors of the Metals Service Center Institute, a non-profit association serving the industrial metals industry. Mr. Lehner also has served on the Board of Directors of Modumetal Inc., and The Mississippi State Workforce Investment Board. Mr. Lehner earned a bachelor’s degree in accounting from the University of Cincinnati. Mr. Lehner’s substantial prior experience as a senior executive for multiple metals companies has led the Board | ||||

RYERSON 2024 Proxy Statement |16

Board of Directors

| Stephen P. | Director since: | ||

October 2014 | ||||

Stephen P. Larson currently serves as the Chairman of our Board. Mr. Larson completed a 35-year career with Caterpillar Inc. in 2014 after holding multiple positions in the areas of accounting, finance, marketing and logistics. Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. His senior leadership positions for Caterpillar included roles as Product Manager; Regional Manager for Canada and the Eastern United States; Vice President, Caterpillar Financial Services - Asia Pacific; Caterpillar Logistics President - Americas region; and from 2007 until his retirement, Vice President, Caterpillar Inc. and President and Chairman of Caterpillar Logistics Services, a wholly-owned subsidiary of Caterpillar Inc. From November 2015 to August 2016, Mr. Larson served as Interim Chief Executive Officer and was already a member of the board of directors of Neovia Logistics Services, LLC (formerly Caterpillar Logistics Services), a global industrial contract logistics company. Mr. Larson previously served for six years as a Commissioner on the board of the Metropolitan Airport Authority of Peoria, Illinois. He earned a Bachelor of Business Administration and a Master of Business Administration, both from Western Illinois University. Mr. Larson’s experience in accounting, finance and other areas for a large international manufacturer has led the Board to conclude that he has the background and skills necessary to serve as a director of the Company. | ||||

| Philip E. | Director since: | ||

April 2014 | ||||

Philip E. Norment is a Partner at Platinum. He is a member of Platinum’s Investment Committee, and the President, Portfolio Operations, responsible for evaluating acquisition opportunities and integrating new acquisitions into the portfolio. Prior to joining Platinum in 1997, Mr. Norment served in a variety of management positions at Pilot Software, Inc., achieving the position of Chief Operating Officer. Over the course of 12 years, he worked in the areas of global support, operations, consultative services and sales support. Mr. Norment has served and currently serves | ||||

RYERSON 2024 Proxy Statement |17

Board of Directors

Meetings of the Board and Board Committees

During 2020,2023, our Board met sixfour times. To monitor COVID-19’s impact on our business, our directors held a special meeting with management in April 2020. In addition to the meeting of the full Board, directors also attended meetings of Board committees on which they served. All of the directors attended at least 89%75% of the meetings of the Board and the committees on which they served. While we do not have a formal policy requiring them to do so, we encourage our

|

directors to attend our annual meeting of stockholders.

All of our seven directors attended our 20202023 annual meeting of stockholders,, which we held virtually due to the COVID-19 pandemic. except for Mr. Carruthers.

The standing committees of the Board, with the membership indicated as of February 28, 2021, are set forth in the table below. The Board has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Board also appoints an ad hoc Pricing Committee from time to time as needed. In July 2020, the Pricing Committee comprise of Messrs. Kotzubei, Norment, and Larson met to approve the refinancing of the Company’s senior secured notes.RYERSON 2024 Proxy Statement |18

|

|

|

| |||||

|

|

| ||||||

|

| |||||||

|

| |||||||

|

|

| ||||||

|

|

| ||||||

|

|

| ||||||

|

|

|

|

|

|

|

|

|

Corporate Governance Matters

Our policies and practices reflect corporate governance standards that comply with the NYSE rules and the corporate governance requirements of the Sarbanes-Oxley Act, including:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under our Bylaws, the Board may appoint one of the directors as Chairman of the Board. The Chairman of the Board may be a management or a non-management director and may or may not be the same individual as our CEO (if our CEO is a director), at the option of the Board. The Board believes it should be free to make this determination depending on what it believes is best for the Company in light of all the circumstances. The Board appointed the Company’s CEO is currently not a memberto the Board on February 17, 2022. Further, the Board appointed Stephen P. Larson as the Chair of the Board andon January 31, 2024. Prior to Mr. Larson's appointment, the Board currently doesCompany did not have a ChairmanChair of the Board. This leadership structure also allows our CEO to focus his time and energy on operating and managing the Company, helps ensure accountability for the actions and leverages the experiences and perspectives of allstrategic direction of the Company’s directors.Company, and assists the Company in presenting its message and strategy to stockholders, employees and customers.

Our directors meet at regularly scheduled executive sessions without management present, usually in conjunction with regularly scheduled Board meetings. In addition, at least once each year the independent directors meet in executive session without any other persons present. One of our independent directors is chosen by the directors at each such session of independent directors to preside over the session.

|

Controlled Company Status and Director Independence

As stated above, because Platinum owns more than 50% of the voting power ofAll our common stock, wedirector nominees and directors, except for Mr. Lehner, our CEO, are considered to be a “controlled company” for purposes of the NYSE rules. As such, we are permitted, and have elected, to opt out of the NYSE rules that would otherwise require our Board to be comprised of a majority of independent directors and require our Compensation Committee and Nominating and Corporate Governance Committee to be comprised entirely of independent directors.

independent. For a director to be considered independent under the NYSE rules, our Board must determine that the director nominee (or director) does not have any material relationship with the Company. To assist in making this determination, our Board adopted a policy on director independence based on the NYSE’s independence standards. A copy of the policy is available on the corporate governance page on our website, which can be found at ir.ryerson.com by clicking on “Governance.”

Under our policy on director independence, a director will be considered independent only if the Board has affirmatively determined that the director has no material relationship with the Company that would impair the director’s independent judgment. In the process of making such determinations, the Board will consider the nature, extent and materiality of the

RYERSON 2024 Proxy Statement |19

Corporate Governance Matters

director’s relationships with the Company. When assessing the materiality of a director’s relationship with the Company, the Board should consider the issue not only from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation. The Board will consider all relevant facts and circumstances in rendering its “independence” determinations. Material relationships can include commercial, banking, consulting, legal, accounting, charitable and familial relationships, among others. In addition, a director will not be deemed “independent” for purposes of service on the Board if such director:

|

|

|

|

|

|

|

|

|

|

For purposes of the Company’s policy on director independence, “immediate family member” means any of the person’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law and brothers-andbrothers- and sisters-in-law and anyone (other than domestic employees) who shares the person’s home.

The Board has determined that Mses. Kalawski, and Sigler, Messrs. Calhoun, Carruthers, Kotzubei, Larson, and LarsonNorment are, or during 20202023 were, independent within the meaning of the NYSE rules or our policy on director independence. Further, the Board has determined that Mses. Kumbier and Leggio are independent within the meaning of the NYSE rules or our policy on director independence.

As stated above, our Board of Directors unanimously recommends a vote “FOR” the election of the Board’s nominees identified above.

Board Oversight of Risk

Board Oversight of Risk

Our Board as a whole has responsibility for overseeing our enterprise risk management. Themanagement ("ERM"). As a general matter, the Board and the Audit Committee assess whether managementthe Company has an appropriate framework to manage risks and whether that framework is operating effectively. On a regular basis, the Board and its committees engage with management on risk as part of broad strategic and operational discussions which encompass ongoing risks, as well as on a risk-by-risk basis.mitigate risks. The Board exercises its oversight responsibility directly and through its committees.

|

As a general matter, the Board and its committees are informed by reports from our management team and from our internal audit department that are designed to provide visibility to the Board about the identification and assessment of key risks and our risk mitigation strategies. In carrying out this critical responsibility, the Board has designated the Audit Committee with primary responsibility for overseeing certain specific enterprise risk management,risks, including financial, cybersecurity,cyber security, legal, sustainability and market risks. For the other committees' role in overseeing risks, please see "Committee Roles" on page 22 and "Board Committees" on page 24.

In order to address its enterprise risks, the Company has implemented an ERM program. The purpose of the program is for the Company to monitor risks to strategic objectives, identify the top risks annually from a risk universe of over 50 risks, and develop, implement and track key mitigation plans for the identified risks. The annual process to identify current top risks and mitigation efforts consists of two sets of interviews of senior leadership by the ERM Committee headed by our CFO and by our internal audit department, respectively. Throughout the year, the ERM Committee also conducts interviews with relevant risk owners to track risks and status of mitigation plans.